Your guide to the freight brokerage industry.

-

When do freight brokerages start thinking about building their own TMS?

It’s an interesting question for any high growth freight brokerage. It’s also a fun question to speculate on whenever and wherever you’re talking shop.

-

What TMS software are Micro-Cap freight brokerages using?

Brush Pass Research has been busy combing through the FMCSA census file of active freight brokerages making calls and collecting data.

-

Still no traction in the freight brokerage market

Despite a slight uptick in closures during March 2025, the year-over-year contraction rate for freight brokerages is still easing. Compared to March 2024 there are -8.6% fewer brokerages.

-

Freight brokerage growth finally catching a break

In February, the number of active brokerages only dipped by 52 — a far cry from the massive losses we saw last year when 3,104 brokerages exited the market.

-

January 2025 Freight Brokerage Data: A Positive Outlook

The year-over-year decline in freight brokerages was 9.9% in January, signaling a deceleration of the trend over the past two years.

-

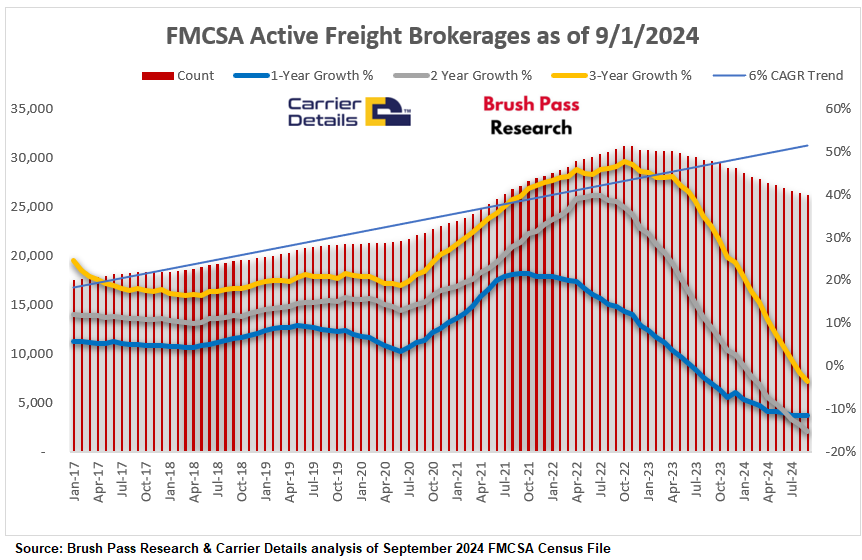

2024 closes with 3,104 fewer freight brokerages

The freight market has taken a beating over the past few years. By the end of 2024, we saw 3,104 fewer freight brokerages than the year before. Add that to the 2,395 closures in 2023, and it’s a total of 5,409 fewer brokerages in the game since January 2022. This hits especially hard when you…

-

Negative numbers continue for freight brokerages in November 2024

While the freight market shows signs of heating up, negative numbers continue for freight brokerages. There are now 181 fewer freight brokerages heading into the final month of 2024. The average number of closures each month in 2024 has been 257. Based on the historical growth trend of new brokerages over the past 10 years,…

-

Brokerage declines ease in October 2024

For the first time this year, the decline in freight brokerage authorities has finally eased up a bit.

-

September 2024 shows another decline in freight brokers

Year over year, the number of freight brokerages has dropped by -11.8% and -16.7% compared to two years ago.

-

Average Gross Revenue per Employee in Freight Brokerages: $1,267,516

It is $1,267,516, according to financial data covering the past 4 quarters. This data is now part of the new annual gross revenue intel added to each freight brokerage in our premium data set.

-

19th consecutive month of negative growth in freight brokerages

Another month, another 188 freight brokerages that no longer have authorities..This is the 19th straight month of year over year declines. As of August 31 there are now 26,216 active freight brokerages registered with the FMCSA.

-

3,420 fewer freight brokerages in August 2024 than a year earlier

In percentage terms there are -11.5% fewer freight brokerages than a year ago, -13.8% fewer than two years ago, and -1.4% fewer than three years ago.

-

Snapshot of credit profiles for the largest freight brokerages

Capacity is loose. Rates are stagnant. And freight brokerages have not been immune to financial implosion during this down cycle. With that said the overall picture of credit scores for the largest 1,650 freight brokerages are not as bad as one might imagine.

-

June 2024 freight brokerage declines (11.6%) year-over-year

YoY declines in active freight brokerages have accelerated downward each month in 2024. Starting in January at (7.8%), reaching double digits in April, and now at (11.6%).

-

June data shows continuing slump for freight brokerages

2024 continues its rough year for freight brokerage growth. The net change in freight brokerages (New active authorities minues inactive authorities) continues to spiral. The only time period worse was is in 2013 when 7,991 authorities went inactive before the minimum on surety bonds were raised.

-

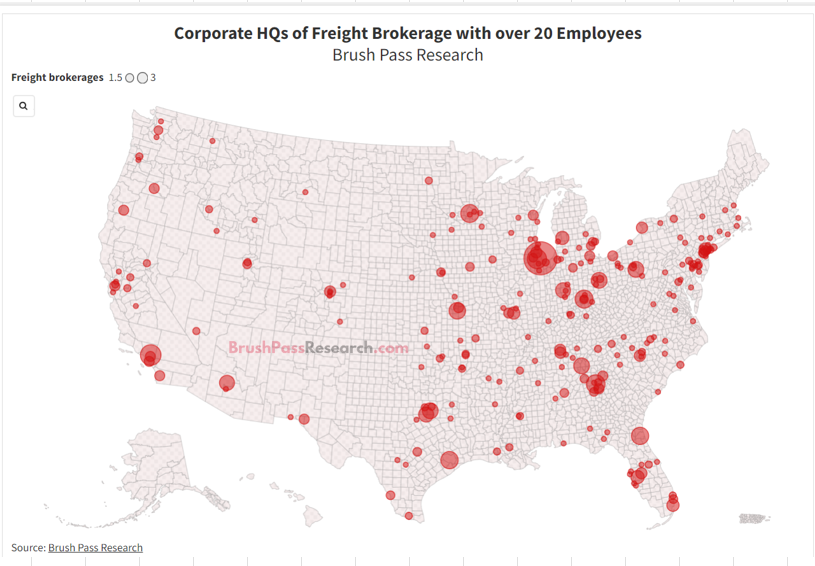

Where are the largest freight brokerages located?

Most freight tech solutions are designed for larger brokerages. Finding large brokerages in the ocean of over 27,000 active brokerages can be challenge though.

-

3,200 fewer freight brokerages than in May 2023

Freight brokerages closures slightly accelerated YoY in April, inching up to -10.8% year-over-year compared to -10.6% last month. There are now 27,206 active freight brokerages compared to 30,406 at this time last year.

-

How many distribution centers are there across the US?

The answer, according to my good friend Dyc McLeod at HighlanderTek who’s the expert, is just over 14,500 distribution centers across the US. What does it take to be classified as a distribution center by Dyrc? It is a minimum of 250,000 square feet.

-

Largest 1,000 brokerages generate 88% of all gross revenue

The top 1,000 freight brokerages are about 3.5% of all the active entities now make up 88% of the gross revenue in this now $135b market.

-

2023 freight brokerage revenues decline 15.1%

It’s been quite the freight “recession” or should we say freight “depression”. April 2024 marks the 25th month of this down cycle in the truckload market. When or how this cycle comes to its natural conclusion is anyone’s guess. Based on what we are hearing this market could roll across the floor for quite a…

-

March 2024 shows double digit freight brokerage closures

Freight brokerages closures accelerated again YoY in March 2024 at (10.6%). There are now 27,450 freight brokerages with active MC numbers compared to 27,864 one month ago.

Got any research ideas?

Brush Pass Research

Brush Pass Research provides sales teams with the company tech intel and contact details they need to prospect faster and smarter. Their database includes over 12,000 decision-makers at the largest 1,000 freight brokerages in North America.

With Brush Pass Research, sales teams can identify the right freight brokerages to target, connect with key decision-makers directly, avoid wasting time on unqualified leads, and accelerate their sales cycle.

Brush Pass Research is the perfect solution for sales teams of all sizes. Whether they’re just starting out or they’re looking to expand their reach, Brush Pass Research can help them close more deals and grow their business. Sign up for a free trial today at www.brushpassresearch.com and see the difference Brush Pass Research can make for your sales team.

About Kevin Hill

Kevin Hill is a respected expert in the freight industry, with over 10 years of experience in sales, marketing, and media production. He is the owner of Brush Pass Research, a sales and marketing research firm that helps companies sell to freight brokerages across North America.

He is also the host of Put That Coffee Down, a popular freight sales show on FreightWavesTV. Kevin is passionate about helping freight sales professionals grow their businesses and reach their goals.

He is known for his insightful analysis of the freight industry, his practical sales advice, and his engaging and informative speaking style. He is a regular speaker at industry events and has been featured in numerous publications, including FreightWaves, Transport Topics, and Logistics Management. Kevin is also a successful entrepreneur. He previously founded CarrierLists, a carrier sourcing platform that was acquired by Highway in 2022.

- Contact us at sales@brushpassresearch.com

- Create a free account at www.brushpassresearch.com

- Follow us on LinkedIn